Credit Cards Vs Personal Loans: Which One Is Fair For You?

It’s always a good idea to check your credit scores before you decide on which type of loan you want to borrow. Before applying for a personal loan, it is important that you do research on the different types of loans available. One option is a personal loan, which offers lower interest rates and no collateral required. Another option is a secured or unsecured credit card with an APR that ranges from 13% – 19%. A final consideration is how much money you need to borrow and how long you will need the money for. Then, you can make a more conscious choice.

Personal loans can be useful for paying expenses such as a home repair, medical bills or tuition. Personal loans may also be an option if you need to borrow money for a wedding or vacation. A personal loan has many benefits over a credit card, including lower interest rates and fixed monthly payments through automatic debiting from your account. You will need to apply with a lender and pass several requirements such as income verification and credit evaluation to qualify for this type of loan. The amount of your loan depends on your income and credit score but generally do not exceed $40,000.

Personal Loans Vs Credit Cards

There are some similarities between a personal loan and a credit card. Both allow you to borrow money and pay it back through regular monthly payments. However, there are also some differences between a personal loan and a credit card that may affect your decision on which type of loan to take out. Personal loans offer lower interest rates than credit cards while allowing you to repay your debt over longer periods of time as opposed to the quick and easy 30-60 day repayment period with credit cards. Borrowing on a personal loan may affect your ability to get additional loans should you need more money in the future, whereas this is not an issue when using a credit card.

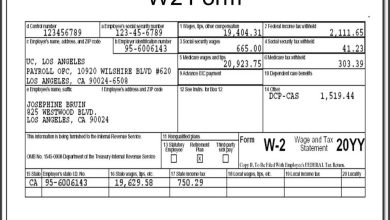

Pre-qualification is not the same as pre-approval. When you apply to a bank, you are showing your income and debt. In order for them to give you a loan, they need all the information about your credit score, down payment etc. If they approve your loan, it means they know that you can pay back in time period that you agreed on. However, this is not a guarantee that you will get the money if your credit score has changed or increased since then or if for some reason at the time of approval factors change which means that they cannot approve it. The exact date when pre approval ends depends on each lender but it usually lasts up to 30 days after application.

When Is It The Good Time To Use A Personal Loan?

It is important to understand that the decision to borrow money is a personal one. Banks and loan providers use different factors when evaluating a potential borrower’s creditworthiness, such as current employment status, income, credit score and previous debts or bankruptcies.

A personal loan is an easy way for you to get the money you need and decide how much you want to borrow. It can help you save time for researching the best offers and comparing information from different lenders. Your financial consultant will analyze your situation, review your financial records, conduct pre-approval checks, give advice on repayment amounts and arrange the loan for you. A personal loan can help you avoid debt consolidation and also keep your financial situation on track.

Personal loans benefit people who are new to fixed monthly payments as interest rates tend to be lower than for other major loans (credit cards, mortgages, car loans etc.) and the length of the loan term is often shorter. However, a personal loan may not be suitable for everyone considering taking out. There are certain individuals who would not be a good candidate for a personal loan because they do not have enough money or a good history of repaying their debts.

When To Use A Credit Card?

Personal loans are only available for an approved credit history but if you don’t have much credit history or a good payment record, then use a credit card. But make sure that your credit score is at least 740 to get a good interest rate on your loan. A personal loan may not be the best option if you are looking for a solution to cover an emergency expense. If you’re using it to fill in the gap between pay periods, then don’t miss any time without paying off what is owed. Many of the benefits of borrowing on credit cards are worth the higher rate, as long as you use them responsibly.

Credit cards can still be used to pay for purchases that are important, such as a new car or major appliances. They can also be used for necessities such as groceries and household items. However, they should not be used to treat yourself or splurge on frivolous purchases. If you want to have a nice vacation but don’t have enough saved up for it, consider using your credit card and paying off the balance at the end of the trip instead of spending too much money now without paying off what you owe back on your credit card sooner than later.

Is A Personal Loan Or Credit Card Better For Your Credit Score?

While both a loan and credit card may adversely affect your credit score, using them in moderation can actually help your financial health. Whether you have a line of credit or a loan depends on what you borrow – and how much you can afford to repay. Using just one method of borrowing can be limiting, but using both can help improve your financial health. If you are planning on applying for a secured loan, it is important that you use a specific amount as collateral when applying. So, If you plan on applying for any unsecured loan, make sure that you have at least a 720 credit score.

If you have a credit card, try to use it as little as possible. This is because you are judged based on your ability to pay all of your bills on time. If you have no available credit, it may put a negative effect on your score because it is a sign that you are living beyond your means or that you tend to overspend. You should also think about how much debt you currently carry before applying for new loans or cards. The lower the number is, the better – especially if it’s below 10%.

Final Thoughts –

If you are considering a loan for a long-term purchase such as a car or home, making the monthly payments will prevent you from piling up credit card debt. However, if you need money for something that will only last for a short period of time – your phone bill may not be worth the high cost of a personal loans. Credit cards provide very little protection to help borrowers avoid hardships in the event of an emergency and therefore should only be used as a last resort when paying for an unexpected expense. If you have large debts already, it is not always good to get another loan until you have paid off what you owe. Contact the financing institutions like Same Day Cash Loan and get the additional funds you need fast.