Why credit cards are not considered to be money

Why credit cards are not considered to be money

Credit cards are commonly used to purchase goods and services. Are credit card transactions or credit card debt involved in demand deposits or money supply? If not, why were they not included in the definition of the money supply?

This is a recurring question- the answer lies within the key difference between assets and liabilities. Money is a financial asset that one can spend – it represents a current asset that can be used to purchase goods or services. When calculating the money supply, financial assets such as currency and deposits are included in the Federal Reserve. In contrast, credit cards are debt liabilities.

Each credit card transaction creates a new debt from the credit card issuer. Ultimately the loan needs to be repaid with a financial asset—money. For families, a line of credit attached to a credit card is not a financial asset, just a convenient means of borrowing to finance a purchase.

Money is a financial asset, something that serves as a medium of exchange serves as a standard of value that is generally acceptable for the purchase of goods and services or for the repayment of loans, and as a measure of accountability. acts as a unit. Federal Reserve Board’s primary measures of money supply include primarily currency as well as financial assets on deposits with financial intermediaries and assets held by households in money market mutual fund accounts.

The Federal Reserve’s two most popular monetary aggregates

Federal Reserve’s two most popular monetary aggregates are M1 (the most liquid financial asset) and M2 (M1 plus other liquid financial assets). The third measure of money supply, the M3, would be discontinued in 2006.

M1 includes financial assets. A non-bank public that can be used for transactions (mainly currency, demand deposits, and now accounts). As of October 2005, M1 was $1,362 billion on a seasonally adjusted basis.

M2, which includes M1 plus consumer time and savings deposits, and retail money market mutual fund shares, was $6,629.5 billion. For a more complete definition of the components of money supply and current money supply data, please see the Board’s weekly H.6 release, Money Stock Measures, and Ask Dr. Akon for April 2004.

A Credit Card Transaction Creates a Liability

Using credit, such as a credit card, is effectively the same as taking out a loan – the loan is an obligation to the borrower. Samuelson and Nordhaus (2001) describe credit as,

“… the use of someone else’s money in exchange for a promise to pay back (usually with interest) at a later date.”

Credit cards provide a way to purchase goods and services which is an alternative to using money. However, instead of purchasing goods with existing financial assets – such as the types of financial assets

defined as money and included in money supply figures – credit card transactions create debt that the buyer-borrower must pay off later.

The category of consumer loans that includes credit card lending is called “revolving credit”; This measure was $801.4 billion on a seasonally adjusted basis as of October 2005. Additional details on outstanding consumer loans are available from the Board’s monthly G.19 release, Consumer Credit. Pet care adda

In recent years, as shown in Chart 1, outstanding revolving credit has exceeded commercial banks as consumer lending has shifted toward loans backed by home equity lines of credit.

In addition to rapidly increasing home prices, creating home equity, home equity loans secured by Housing Equity are typically priced much lower than the rates on unsecured credit card debt.

What is a Credit Card?

A credit card processing is a card issued by a financial institution, usually a bank, and it enables the cardholder to borrow money from that institution. The Cardholder agrees to return the money along with interest, in accordance with the terms of the institution. Credit cards are issued in the following types of categories:

- Standard cards simply extend a line of credit to their users to make purchases, balance transfers, and/or cash advances and often have no annual fee.

- Premium cards offer concierge services, airport lounge access, special event access, and more, but they usually have a higher annual fee.

- Rewards cards offer customers cash back, travel points, or other benefits depending on their spending pattern.

- Balance transfer cards have lower introductory interest rates and fees on balance transfers from other credit cards.

- Secured credit cards require an initial cash deposit that is held by the issuer as collateral.

- Charge cards have no preset spending limit, but often do not allow carrying unpaid balances from month to month.

What about debit cards?

Unlike credit card purchases, debit card purchases transfer money electronically from personal and business bank accounts to seller accounts. Debit card spending will affect demand deposits and money supply in the same way as checks or cash purchases. Because a debit card transfers your existing financial assets.

the financial assets that you can access with a debit card—are included in the money supply.

Why is it important to distinguish between financial assets?

Why is it important to distinguish between financial assets (such as money) and liabilities (such as credit card debt)? First, from an economic point of view, the Fed measures the amount of money

In the hands of the public because of its potential use as an indicator of monetary policy; Measures of money supply reflect the different degrees of liquidity that exist in different types of money. See Ask Dr. Akon (January 2003) for some historical perspective on the use of monetary aggregates.

The Fed monitors the amount of money in the economy and tracks the amount of existing consumer credit. While both the money supply and current credit card debt can be important indicators of trends in the economy.

Financial assets (money) and liabilities (credit card debt) may not behave equally over time.

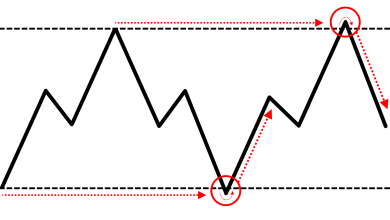

the relationship between the M2

Chart 2 compares the relationship between the M2 monetary total and the growth rate for credit card debt (revolving credit) over the period 1985 to 2005. During this period, money and consumer credit growth rates often move in opposite directions

one must be careful to remember that correlation (even if negative) does not necessarily imply causation!. The point is that various economic factors will affect the money supply and the rate of growth of credit card debt.