How to Improve credit score with Active Credit

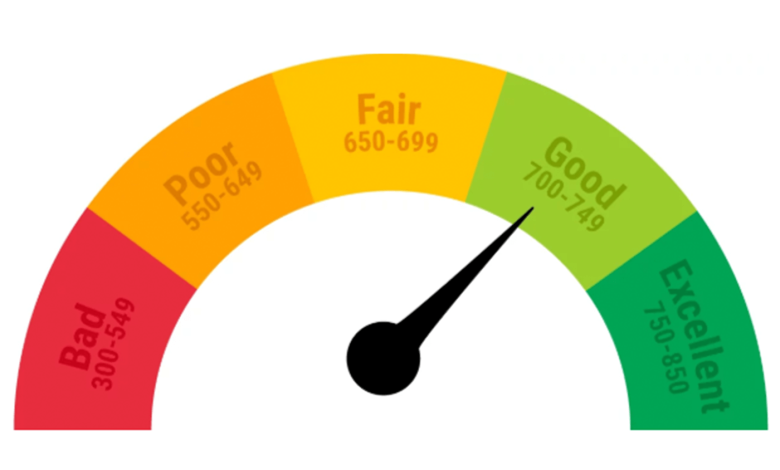

One of the most important things you can do in money and borrowing to maintain financial health is to have a decent credit score. This three-digit number measures how lenders analyze risk and determine how likely you are to repay loans. As a result, your credit score will determine whether or not you can obtain a personal loan or mortgage and the interest rate you will receive on such loans.

Fortunately, your credit score is not a fixed figure. If your credit score is now less than ideal, you may improve it with drive and dedication to a good or exceptional score. This post will read about all aspects of Improving Your Credit Score.

So, exactly what is a credit rating?

Assume you want to get a credit card. To apply, go to your bank’s website and fill out some information about yourself and your finances. Then, your bank will review your credit report, showing previous dependability in managing and repaying debt, such as loans, credit cards, and bills. Your credit report is a complete record of your credit history that includes personal information, credit account information, and public data.

This report, along with any extra information provided by you, will be used to compute your overall credit score. It will demonstrate to potential lenders how dependable you are with repayments.

The higher your credit score, the lower your risk to a potential lender. Thus banks are more willing to lend to you.

In other words, if you have a poor credit score, you will not be approved for that credit card because a low credit score equals a big financial risk.

How is a Credit Score Calculated?

You must first grasp how credit scores are determined if you wish to improve them. While several scoring models exist, they all take comparable factors into account. These elements may include:

- Payment history

- Credit history length;

- Your debt-to-credit-limitation ratio;

- How much debt do you owe;

- Fill out credit applications.

How to Improve Your Credit Score?

The following are the steps you should consider if you are looking for the best ways to Improve Your Credit Score?

Examine Your Credit Report

The first step is to restore your credit and make sure that it precisely reflects you and your financial history. One of the most common complaints is the incorrect information on credit reports. According to one survey, one out of every five persons has a mistake on at least one of their credit reports. Errors might lower your credit score and make you look to be a high-risk borrower. As a result, your prospects of receiving credit may be damaged, and you may wind up paying more money.

Some of the common mistakes to look out for:

- Errors in Personal Information: Examine for misspelled names, addresses, and phone numbers. Check that all of the accounts shown on the report are, in fact, yours. You may discover accounts that do not belong to you if you have been a victim of identity theft.

- Errors in Balance Check the report to ensure that all balances and credit limits are valid.

- Account Status Errors: Make certain that the reports appropriately reflect the state of your accounts. Inaccuracies in overdue and delinquent payments may be discovered, such as closed accounts indicated as open. It would be best to double-check that each loan is reported only once

If you discover an inaccuracy, the next step is to contact the credit reporting agency and submit a dispute. You can also submit a dispute with the organization or corporation that provided the credit reporting bureau with the information.

Pay Your Bills On Time

Second, you should pay all of your credit bills on time. Payment history accounts for a big portion of your credit score. After all, lenders are unlikely to lend money to someone who has a history of not repaying what they borrow. If you have a history of late and overdue payments, consider taking the following steps to prevent it from happening again:

Make a financial plan. You need to ensure that you have sufficient money to pay your bills without any hassle. It would be best to create a budget that properly distributes your money to make necessary payments and debt reduction.

Set up automatic payments. Many people make occasional payments because they simply forget it. Set up auto-pay on as many accounts as possible to avoid this. You should still check in on your account once a month to ensure that your monthly payments are being processed accurately.

Pay off your debts on Time

Because a high debt-to-credit ratio might harm your credit score, paying off college loans, auto loans, and other debts is critical. Maintain a low balance on revolving credit accounts, such as credit cards. This is one of the most difficult components of improving your credit score, especially if you have a high balance to pay off. It is, however, critical if you wish to boost your credit score by 200 points.

The quantity of debt affects your credit score, but so does the debt ratio to the credit limit. When considering your ability to repay a loan, lenders prefer to see a low debt-to-limit ratio, the amount you borrow divided by the total amount of credit available to you. Low use ratios demonstrate that you use your credit sensibly.

Once you’ve gotten a handle on your debt, a secured credit card can help you develop a good payback history. It will also prevent you from spending more than you can afford to repay.

Credit Inquiries Should Be Limited

Ladders make a “hard inquiry” into your credit score whenever you apply for a loan, mortgage, or credit card. A high number of hard inquiries might be a red signal and lower your credit score, so keep your total number of credit accounts to a minimum.

Other institutions, such as utility companies, employers, and landlords, may also conduct a credit check. These, however, are referred to as “soft inquiries” and do not affect your credit score.

Lenders should be bargained with.

If collection agencies have purchased your debt, you may be able to negotiate your sum. Lenders may be eager to reclaim as much money as possible, and compromises may be available.

Wrapping the post

Raising your credit score will not be easy or quick. But don’t give up hope: it’s doable with clever money moves, a little research, and patience. Credit scores are rarely taught in school or university (unless you study accounting and finance), but they are very important. They can have a significant impact on your future. If you want to apply for a mortgage, credit card, or loan, you must have a decent credit score. It may also impact your car insurance, bank account, and mobile phone bill. So, in a nutshell, it’s critical.

If you are looking for the best services that can help you improve your credit scores, Active Credit can help! The team of professionals ensures to make your credit score worthy of getting a loan. You don’t have to do much; just provide all the details asked by the Active Credit experts and see the improvement in your credit score in no time.