Bear and Bull Market:A Beginners Guide For Everone

The terms ‘Bear’ and ‘Bull’ are widely used in the trading sector to describe market conditions. These phrases characterize the general performance of financial markets, such as whether their values are increasing or decreasing.

As an investor, whether seasoned or beginner, the market’s direction is a big factor that significantly influences your portfolio. So, it’s critical to comprehend how each of these market circumstances could affect your assets.

Stock markets rise and decrease in response to various factors, including the financial performance of the index’s listed firms, the political and economic climate, and investor confidence.

Continue reading this article to learn more about the Bear and Bull market and how it differs from each other?

What is a Bear Market?

If you’re wondering – What is a Bear Market; here’s an answer to your question.

The bear market can be defined as a market that drops roughly 20% per quarter. It exists when the economy is weakening, and the majority of equities are losing value.

This indicates a bear market, and when this occurs, individuals become extremely hesitant to invest in the stock market.

Bear markets may last from a few weeks to years. The Great Depression was the first and most well-known bear market.

Other examples include the dot-com bubble of 2000 and the housing crisis of 2007–2008.

Causes of Bear Market:

A bear market is one that shows the declining sign of the market. Share prices are falling to the point that experienced investors feel the trend will continue, at least for the time being.

What is a Bull Market?

In this section of What is a Bull Market, we’ll discuss the market conditions and causes.

Bull markets are defined as a market that rises rapidly over a long period of time. As the stock market begins to climb, there is increased stock market greed.

A bull market refers to an increase in a company’s stock price. During these periods, investors believe that the rise will continue in the long term.

During this, the country’s economy is normally strong, and employment rates are also high.

Causes of Bull Market:

Though a variety of reasons causes a bull market, the two most important causes include:

- Strong Economy

- High employment rates

Differences between Bear and Bull Market:

Due to the difference between Bear and bull markets, your financial decisions differ significantly.

Having a bigger equity allocation is considered best in the Bull market as the chances for good returns are very high.

Buying stocks early and selling them before their peak is one strategy to profit from a bull market’s rising values.

Conversely, when there is a greater risk of loss, investing in shares in a bear market should be done with caution, as you are likely to lose money – at least initially.

Here are some of the differences between Bear and bull Market:

Performance of the stock market:

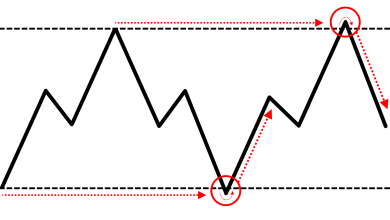

In a bull market, stock prices rise, whereas in a bear market, it falls. Even with occasional minor market declines, the stock market gains value when conditions are optimal.

When the stock market is in a bearish condition, it loses value or holds constant at low levels.

Changes in the unemployment rate

In a bull market, the unemployment rate is dropping. Whereas in a bear market, the unemployment rate is rising.

Businesses establish and hire during bull markets, but they may be obliged to reduce their workforce during bear markets.

A growing unemployment rate tends to extend a bear market since fewer people working means lower revenues for many businesses.

GDP fluctuation:

A bull market is defined by rising GDP, whereas a bear market is defined by declining GDP.

GDP rises as company sales rise and employee compensation rises, allowing consumers to spend more.

When a company’s sales are slow, and salaries are flat or falling, GDP falls. Bear markets are directly tied to recessions and depressions in the economy.

Recessions are officially announced when GDP falls for two quarters in a row, whereas depressions occur when GDP falls by 10% or more and lasts for at least two years.

Inflation rate:

Price inflation can be a concern when the economy is thriving, but it can also happen during a down market.

High demand for products and services can lead to price increases in bull markets, whereas in bear markets, low demand can lead to deflation.

Interest rates:

Interest rates are the main factor of difference between both Bear and Bull Market. See How!

Bull markets are characterized by low-interest rates, while high-interest rates indicate bear markets.

Low-interest rates make it easier for firms to borrow money and expand, but high-interest rates tend to stifle growth.

Which is better to Invest between Bull vs Bear Market?

In bull markets, companies perform well, but value stocks are typically excellent investments in bear markets.

In bull markets, value stocks are less popular due to the belief that “undervalued” stocks must be cheap for a cause while the economy is rising.

Both Bear and bull markets, your time horizon largely determines how you buy stocks.

It doesn’t matter if the market is now bullish or bearish if you won’t need the money for decades.

You shouldn’t adjust your investment plan based on market conditions if you’re an investor that uses a buy and hold strategy.

Regardless of the current market condition, it’s critical to keep your eyes on the long-term prospects of the companies in which you’ve invested.

Companies with strong business fundamentals are more likely to generate good long-term returns for your portfolio.

Conclusion:

Bear and bull markets can have a significant impact on your investments, so it’s a good idea to spend some time conducting market research before making a choice.

But also keep in mind that the stock market has the power to outperform other markets and generate a good return over the long run.

On the other hand, choosing a broker that manages your portfolio efficiently is a must, whether it’s a bullish or bearish market. And our top recommendation, in this case, is InvestBy.

The broker offers a large pool of securities to trade in by providing an advanced trading platform with plenty of research and educational tools that will help you understand the market conditions, whether it’s bullish or bearish.

That’s all! Hope you’ve understood about the Bear and Bull markets.