7 Little Known Ways to When Are W2 Sent Out?

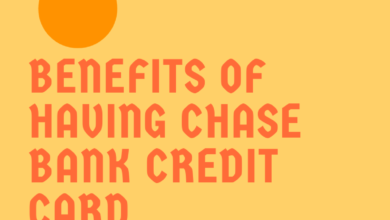

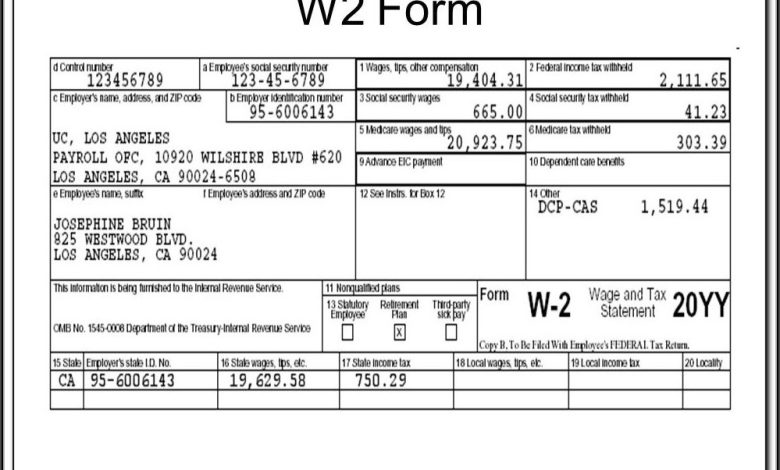

While Boxes 1-4 are fairly straightforward to read, Boxes 1-20 can be tricky. Box A shows the Social Security number of the employee. The number should look like XXX-XXX-XXXX. If you cannot recall an employee’s Social Security number, write “Applied For” in that box. This will allow the employer to issue a corrected W-2 once the SS card arrives.

Getting a copy of a W2

Getting a copy of a W-2 is an important part of filing your taxes. While you can contact the IRS to request a copy of your W-2, contacting your employer is likely the easiest route. Not only is the information more reliable, but it is also less time-consuming. Getting a copy of your W-2 will help you start your tax return for the prior year. Must visit nationaltaxreports.com for all details.

While many employers use payroll software, others still send paper copies to their employees. If your employer does this, you may be able to access it online. Most employers will direct you to a secure web portal to access your W-2. Otherwise, you should call the HR department to request a copy of your W-2.

If you prefer a paper copy, you can request it through a W-2 provider. Some providers offer electronic W-2 forms as well. You can also purchase a physical copy of your W-2 from the IRS or a local office supply store. The IRS also offers sample W-2 forms online, but they are not the same as the actual forms. Regardless of which method you choose, it is vital that you send out copies of your Form W-2 to your employees and to the SSA.

In addition to contacting your previous employer, you can also contact your current employer to see if they’ve sent your W2 yet. Ideally, you’d receive your W-2 by the end of January, but if you’ve missed the deadline, contact your payroll provider or HR representative. In some cases, it’s even possible to contact a manager directly to pick up your W2 if you didn’t receive it.

The IRS has a website where you can request a copy of your Form W2 for the previous year. The website is also a good place to find transcripts. These records contain your Federal tax information and are available for up to ten years. You can get them within ten business days from the time they receive your request.

The W-2 form is a crucial document for your tax return. Not only does it provide information about your income, it also provides a record of your contributions to retirement funds and health insurance. Therefore, if you changed jobs, it’s important to get a copy of your previous employer’s W-2 before filing your taxes.

Filing a W-2

There are a lot of details to consider when filing a W-2 form. For example, you must include your personal information and the amount of taxes withheld. If you don’t include this information, it could cause problems for both you and your employer. It is also important to note that the form must only be used by employees, and not by independent contractors or freelancers. The information contained in a W-2 form includes compensation and bonuses, as well as reported tips and other types of miscellaneous compensation. You can also find out what federal income tax was withheld from your paychecks and the amount you owe by completing Box 2 of the form.

The deadline for filing W-2 forms with the Social Security Administration is January 31. If you fail to submit your form by the deadline, you may have to pay penalties for late filing. If you miss the deadline because of an unforeseen situation, you may be able to file an extension for the W-2 form.

A W-2 form contains information on both the employer and the employee. It includes information on the employer’s EIN, name, and address. It also includes the control number of their payroll processing system. You also need to fill out the last name of each employee. Don’t forget to include the suffix, if there is one.

If you don’t have a W-2, it’s important to contact your employer and request a copy. Make sure the address is correct so you can be sure that your employer will send you a W-2. You can also try to get an electronic version of your W-2 from your employer. Regardless of the method, it’s important to report any errors on your W-2, from misspelled names to inaccurate income amounts. A W-2 that contains errors is not valid and can cause problems with your personal tax filing.

A W-2 is a vital piece of tax paperwork, and it is vital to understand it completely. The IRS has guidelines that help you determine whether you’re an employee or an independent contractor. If you receive an incorrect W-2, you may have to amend your tax filing.

Common mistakes on W2 forms

While errors on W2 forms may not seem like a big deal, they can be extremely costly. Even the simplest mistake on a W2 form can result in an additional fine of $50 or more from the IRS. The best way to avoid costly mistakes on your forms is to report them as soon as you notice them.

Incorrect information on a W2 form can have a big impact on your employee’s federal, state, and local taxes. Inaccurate addresses could cause problems when it comes to withholding taxes for local tax purposes. Also, make sure your employee’s zip code is correct, and that it has the correct number of digits.

Other mistakes that could be costly include employer EIN errors and incorrect tax year reporting errors. If you are an employer and accidentally report the wrong SSN or EIN, the IRS may assess a penalty. In order to fix an error on a W2, you will need to go through a two-step process. First, you will need to correct the EIN and then correct the tax year. Once you’ve corrected these two fields, you can correct the W2.

Other mistakes on a W2 form include the wrong tax identification number. This mistake can be embarrassing for an employee, but there are ways to correct this before filing. You can make changes on your W2 forms using Forms W-2c. Then, make sure you send the new W2 to your employee and the SSA.

Incorrect name: A mistake in the name field is easy to make. The name field should contain the employee’s legal name. If the employee has multiple names, they must join them by using a hyphen or a blank space. You should also make sure to use the correct last name field.

Getting a replacement form

If you did not receive your W2 form, you can get a replacement form by logging in to My Social Security and visiting the Replacement Documents page. Once you’ve logged in, you’ll be able to view and print your form. If you don’t have a printer, you can save the document to your computer instead.

when are w2 sent out First, contact the employer that sent you your W-2. Most employers send out W2 forms by the end of January, so if you’re in touch with the employer early enough, they might be able to supply you with a copy. If they don’t have a duplicate, you can also contact the Internal Revenue Service.

You can also call your former employer and request a replacement form. You’ll need to provide your name, address, and an estimate of how much you were paid during your employment. If you’ve been employed by the same company for more than five years, you may be able to get a replacement form through your former employer’s HR department.

If you haven’t received your W-2 form yet, your best bet is to file for a wage and income transcript with the IRS. This form will include federal tax information, but it will not include state and local information. The IRS will send your transcript within 10 business days.

If your employer sends your W2 form to you, make sure you point out mistakes on it. This will give you time to find a replacement W-2 form. Even if you don’t receive one, you still need to file your tax return on time. If your employer misses the deadline, contact your company’s Personnel/Payroll office to get a new copy.

Other blogs: